Enterprise Content Management for Banks

Banks run on content from regulatory audits to high-stakes client onboarding. But with outdated systems, scattered repositories, and compliance risks, content becomes a liability fast unless it's managed right.

Financial institutions handle a vast mix of critical content: annual reports, policy briefs, onboarding kits, regulatory publications, investment reports, and more.

These aren’t just files, they're pillars of governance, transparency, and public trust. But as compliance demands grow and customer expectations rise, content sprawl gets worse.

What was once neatly organized is now buried across legacy systems and siloed portals. The result? Teams can’t find what they need, when they need it.

This is where Enterprise Content Management (ECM) steps in. Modern ECM doesn’t just store it governs, secures, surfaces, and streamlines. It turns content from an operational drag into a strategic advantage.

Institutions like the Inter-American Development Bank (IADB) did just that using Paperflite’s ECM platform, powered by SEEK, to unify access, boost transparency, and actively engage both the public and government stakeholders.

What is Enterprise Content Management for Banks?

Enterprise Content Management (ECM) in banking refers to the systems and strategies that capture, organize, govern, and surface critical documents like KYC forms, policy briefs, loan files, compliance records, and investment reports securely and efficiently across the organization.

Traditional content management is patchwork: shared drives, email threads, and scattered folders that lead to version errors, security risks, and inefficiencies.

In contrast, a banking-specific ECM centralizes all content, embeds regulatory compliance into workflows, and ensures teams always access the right version securely and at speed.

Top Content Challenges Banks Face Today

Compliance and Regulatory Risks

Banks operate in one of the most tightly regulated industries in the world. From AML directives to data privacy laws, every document must be properly stored, easily retrievable, and fully auditable.

When content is scattered or unmanaged, the risk of non-compliance rises. This can lead to fines, reputational damage, and loss of customer trust.

Siloed Data Across Branches and Departments

Different departments often use different tools to manage content. A sales team might rely on email, while the compliance team uses a separate system.

This fragmentation leads to poor collaboration, duplicated work, and delays in critical decisions.

Legacy Systems and Lack of Centralization

Many banks still depend on outdated systems that cannot integrate with modern tools or scale with business needs. Without a central content hub, teams spend more time searching for files than using them.

Legacy infrastructure often blocks digital transformation.

Poor Content Discoverability

Even when content is available, finding the right document at the right time is difficult. Files may be buried in folders, misnamed, or outdated.

This slows down both internal operations and customer-facing workflows like onboarding or claims processing.

Manual Workflows That Increase Turnaround Time

Processes such as approvals, audits, or customer verifications are still heavily manual in many banks.

These workflows are slow, error-prone, and resource-intensive. Automating them is key to faster, more reliable operations.

Risks from Unauthorized Access

Without proper access controls or visibility into who views or shares content, sensitive financial information can be exposed.

Unauthorized access, whether internal or external, poses serious compliance and security risks.

How ECM Helps Banks Operate Better

Enterprise Content Management isn't just a backend upgrade.

It directly impacts how banks serve customers, maintain compliance, and operate at scale. Here are key ways ECM transforms banking operations:

Security and Compliance

When it comes to enterprise content management system their security and compliance focus on digital transformation, records management, and security. These include those related to ISO standards like ISO 9001, ISO 15489 (Records Management), and ISO 27001 (Information Security), and platform-specific certifications.

This combined with role-based access, audit trails, and document versioning, ECM ensures only the right people access the right content at the right time. Every document action is tracked, creating a secure and fully auditable content environment. This is crucial for meeting regulatory requirements without increasing overhead.

Faster Customer Onboarding

Onboarding delays hurt customer experience. ECM platforms eliminate back and forths by providing instant access to the latest forms, ID proofs, and KYC documentation.

Teams across branches can work off the same updated templates, reducing errors and speeding up the oboarding process.

Workflow Automation

From routing loan applications to escalating compliance alerts, ECM brings structure to repetitive processes.

Automated approvals and archiving remove manual effort and reduce turnaround times, making internal operations faster and more dependable.

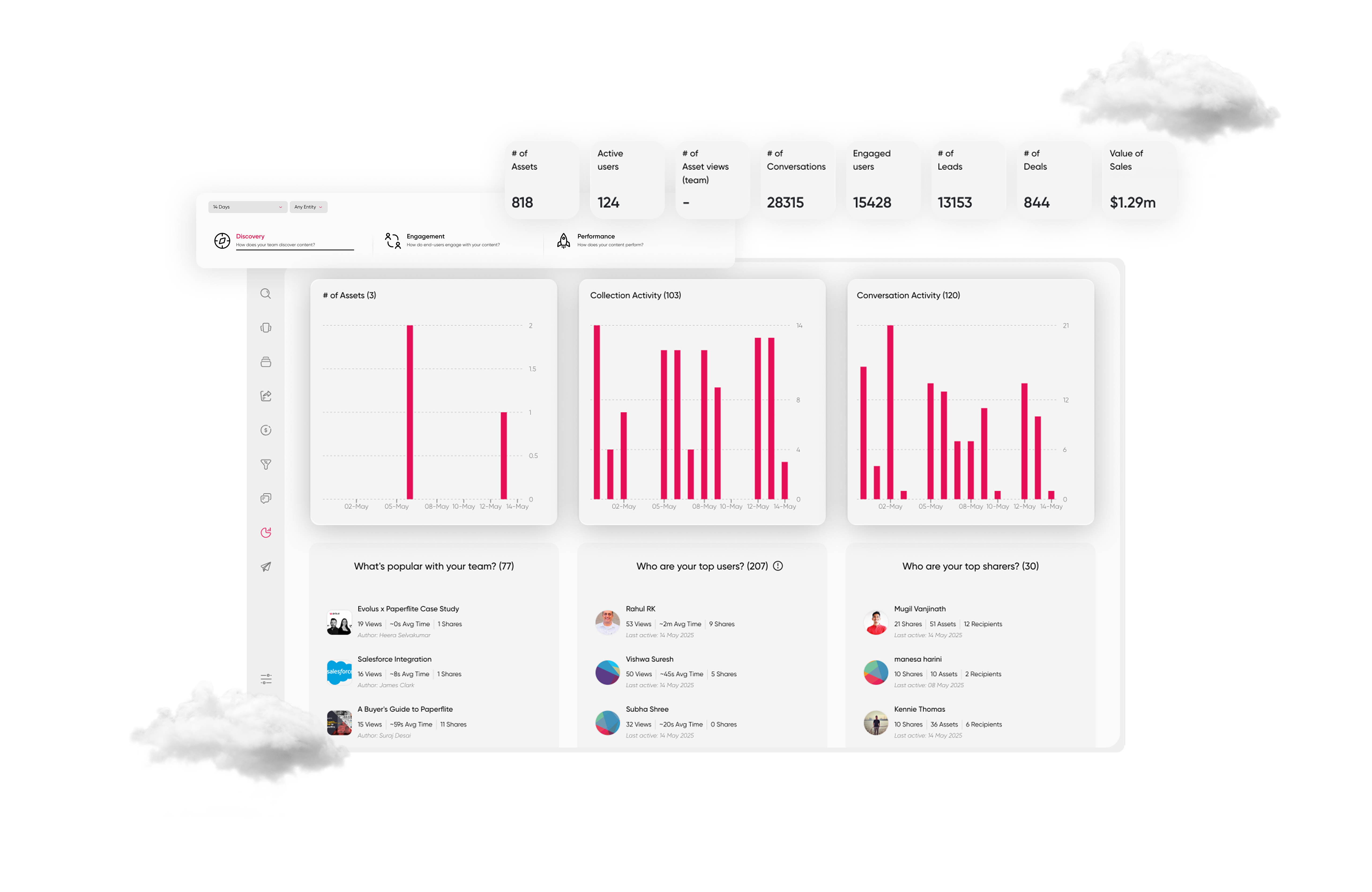

Data-Driven Decisions

ECM platforms can track how content is being used and by whom.

With insights on document views, shares, and engagement, banks can refine what content works best, eliminate outdated files, and make informed decisions tied to actual usage patterns.

Branch-Wide Content Uniformity

Templates, brand assets, and policy documents often differ from one branch to another.

ECM enforces a single source of truth. Whether it is a customer email template or a compliance checklist, every team sees the same approved version.

What to Look for in an ECM Platform for Banking

Not all ECM solutions are built for the demands of modern banking. Here’s a practical checklist of features and capabilities to prioritize when evaluating platforms:

Bank-Grade Security

Look for certifications like SOC 2 and ISO 27001. Your ECM platform should offer data encryption, secure sharing, and enterprise-grade protection for sensitive documents.

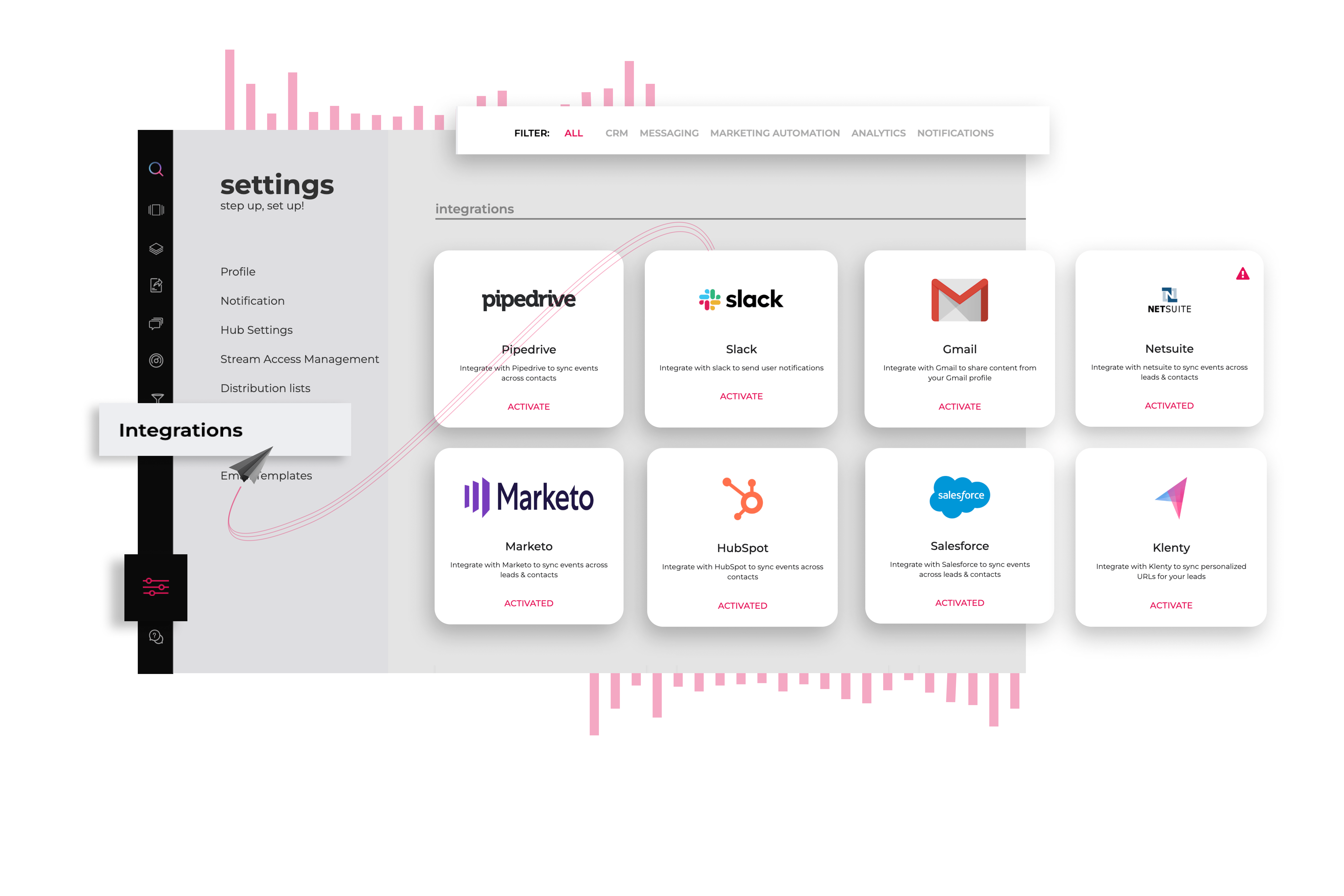

Integration with CRMs and Core Banking Systems

Ensure the platform integrates seamlessly with your existing stack. Whether it is Salesforce, or your in-house systems, your content should flow smoothly between tools.

Support for Audit Workflows

Choose a platform that makes audits easier. This includes version control, access logs, and structured trails that show who did what, when, and why.

Access Controls by Department or Persona

The platform should let you define who can view, edit, and share each document based on roles, teams, or locations. This is essential for both compliance and operational control.

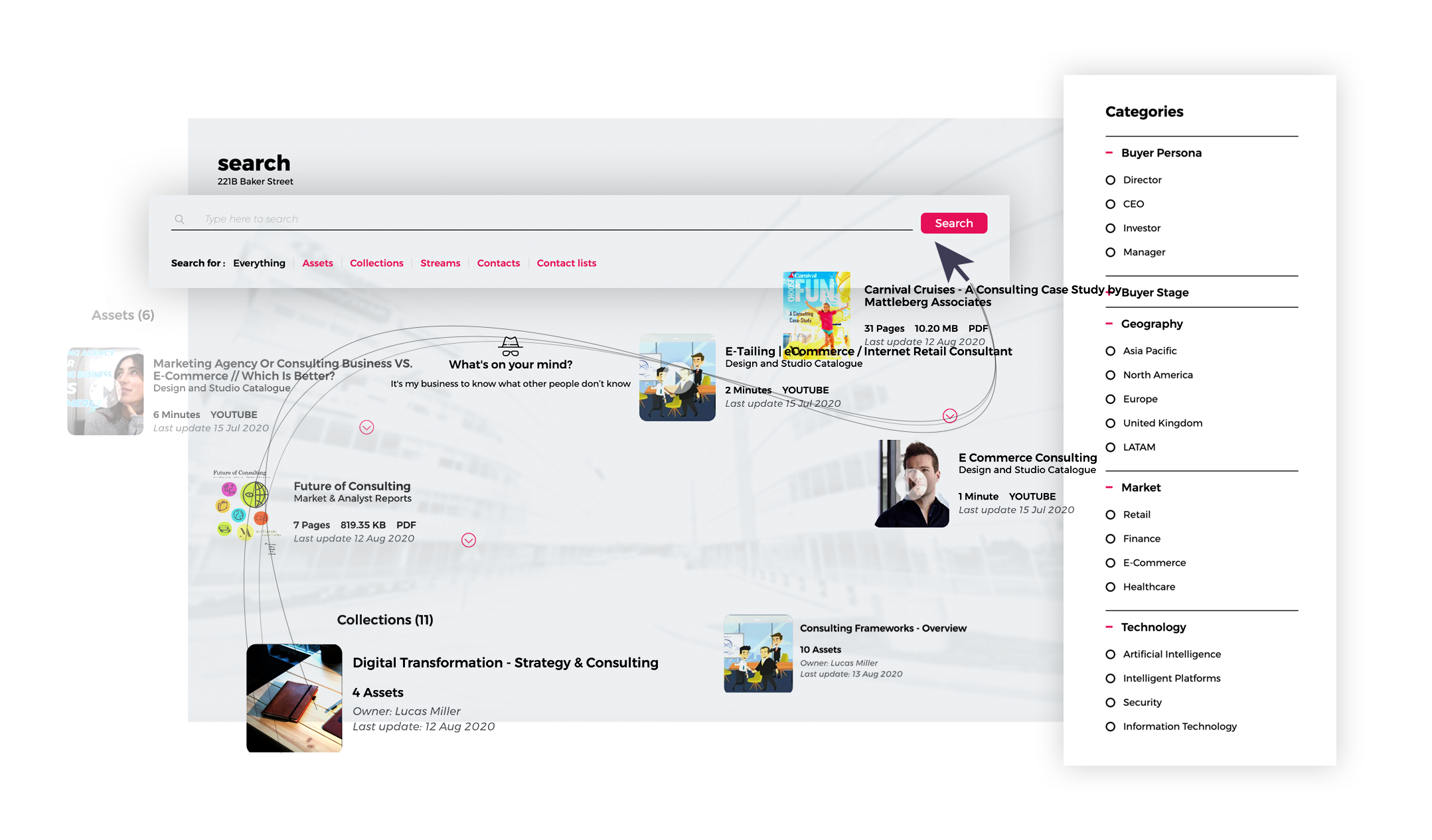

Searchable Content Libraries

Make it easy for users to find what they need. A robust ECM should support metadata tagging, filters, and advanced search so content is always one step away.

Digital Asset Tracking and Analytics

Go beyond storage. Know how your content performs. Who opened it, when, how long they viewed it, and what they clicked. These insights drive better content strategies.

Mobile-First Accessibility

Your frontline staff and relationship managers need access on the go. A mobile-friendly ECM ensures that teams in the field can retrieve, present, and send content anytime.

Why Paperflite is Built for Modern Banks?

Paperflite is more than just an ECM solution. It is a modern content enablement platform designed to meet the complex demands of today’s financial institutions.

From client-facing teams to compliance officers, Paperflite empowers every function to manage and use content with speed, security, and intelligence.

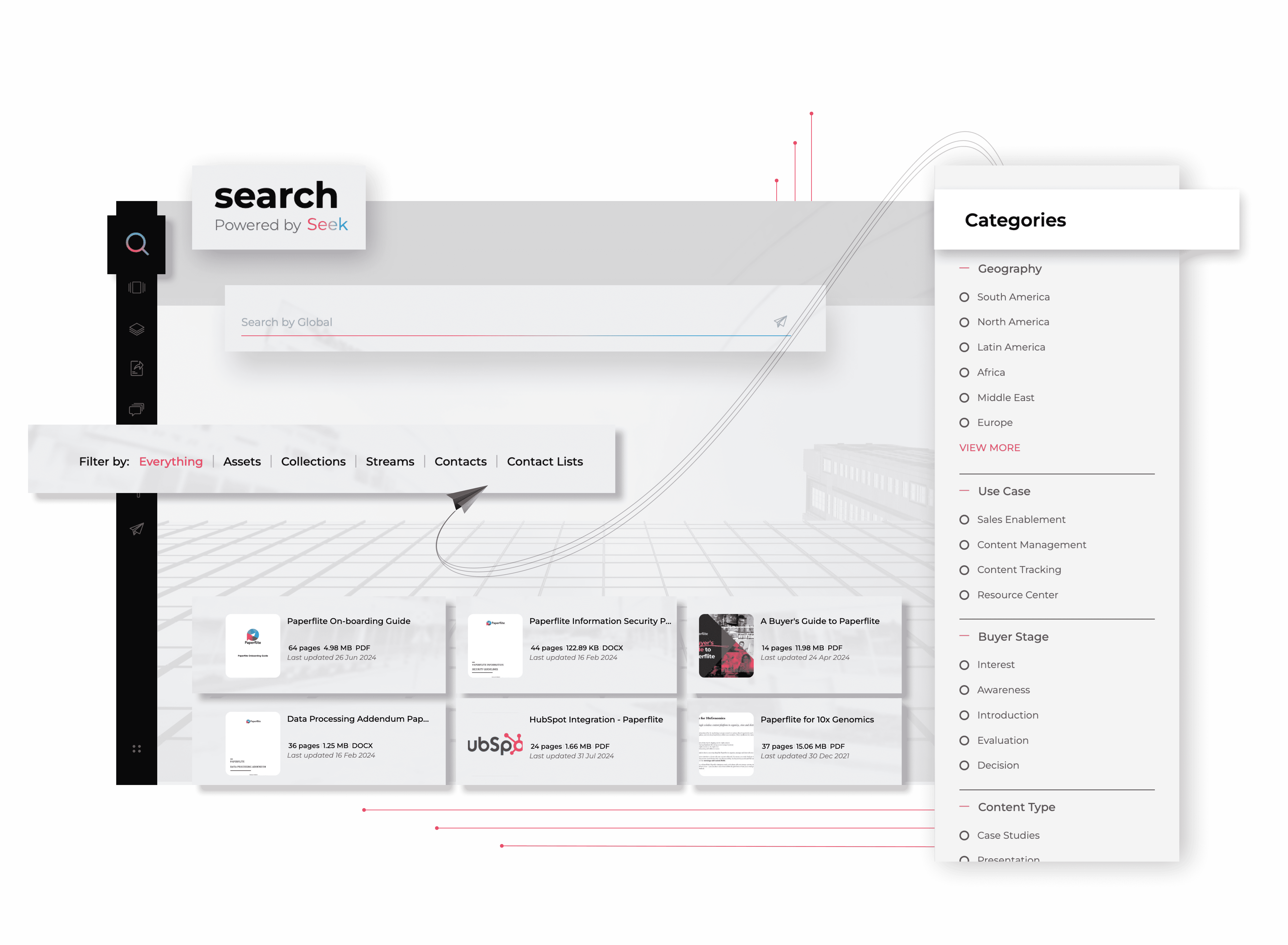

Seek-Powered Content Discoverability

Modern banks need content precision, not chaos. Paperflite’s Seek is an AI-powered discovery engine that changes how financial institutions access knowledge.

Unlike basic ECM searches that rely on filenames or tags, Seek pulls contextual insights from inside documents highlighting exact sections, slides, or datapoints across formats like PDFs, decks, and spreadsheets.

With Seek, institutions can:

- Instantly retrieve content across connected repositories (GDrive, SharePoint, Dropbox).

- Uncover hidden references, regulatory clauses, or product info—even mid-deck.

- Accelerate compliance responses and client engagements without sifting through folders.

Seek ensures time isn’t wasted searching and critical content never slips through the cracks.

Compliance-Ready Architecture

Paperflite’s infrastructure hosted on AWS and powered by MongoDB is built to meet the stringent compliance demands of financial institutions.

It aligns with globally recognized certifications including:

- SOC 1, SOC 2, SOC 3 – Ensures rigorous audit controls around data security and operational integrity.

- PCI DSS Level 1 – Supports secure handling of payment and transaction-related data.

- ISO 27001, 27017, 27018 – Validates adherence to international security standards, with added focus on cloud security and data privacy.

- FedRAMP, FISMA, DIACAP – Meets U.S. federal benchmarks for managing sensitive government-related data.

- FIPS 140-2 – Ensures robust encryption standards for secure data transmission.

- C5 (Germany) – Complies with German federal cloud compliance standards—critical for EU banking operations.

Smart Content Discovery for Relationship Managers

Relationship managers are expected to have the right content at the right moment whether it's a product explainer for a CFO or a market update for a private banking client. But legacy systems bury content in clutter.

Paperflite solves this with smart surfacing. Content is recommended contextually based on:

- Deal stage (e.g., onboarding vs. renewal),

- Client persona (e.g., institutional vs. retail),

- Product type (e.g., wealth management vs. treasury).

These recommendations are dynamic, AI-assisted, and role-specific reducing friction, avoiding errors, and boosting confidence in client conversations.

The result? Faster personalization, higher trust, and improved meeting outcomes.

Real-Time Engagement Tracking

Paperflite doesn’t just send content it monitors content performs once it’s out in the world. Teams can see:

Who viewed a document,

What sections they lingered on,

What they skipped or ignored.

This intel arms sales, advisory, and marketing teams with the behavioral signals needed to refine messaging, trigger timely follow-ups, and know when to escalate or re-engage.

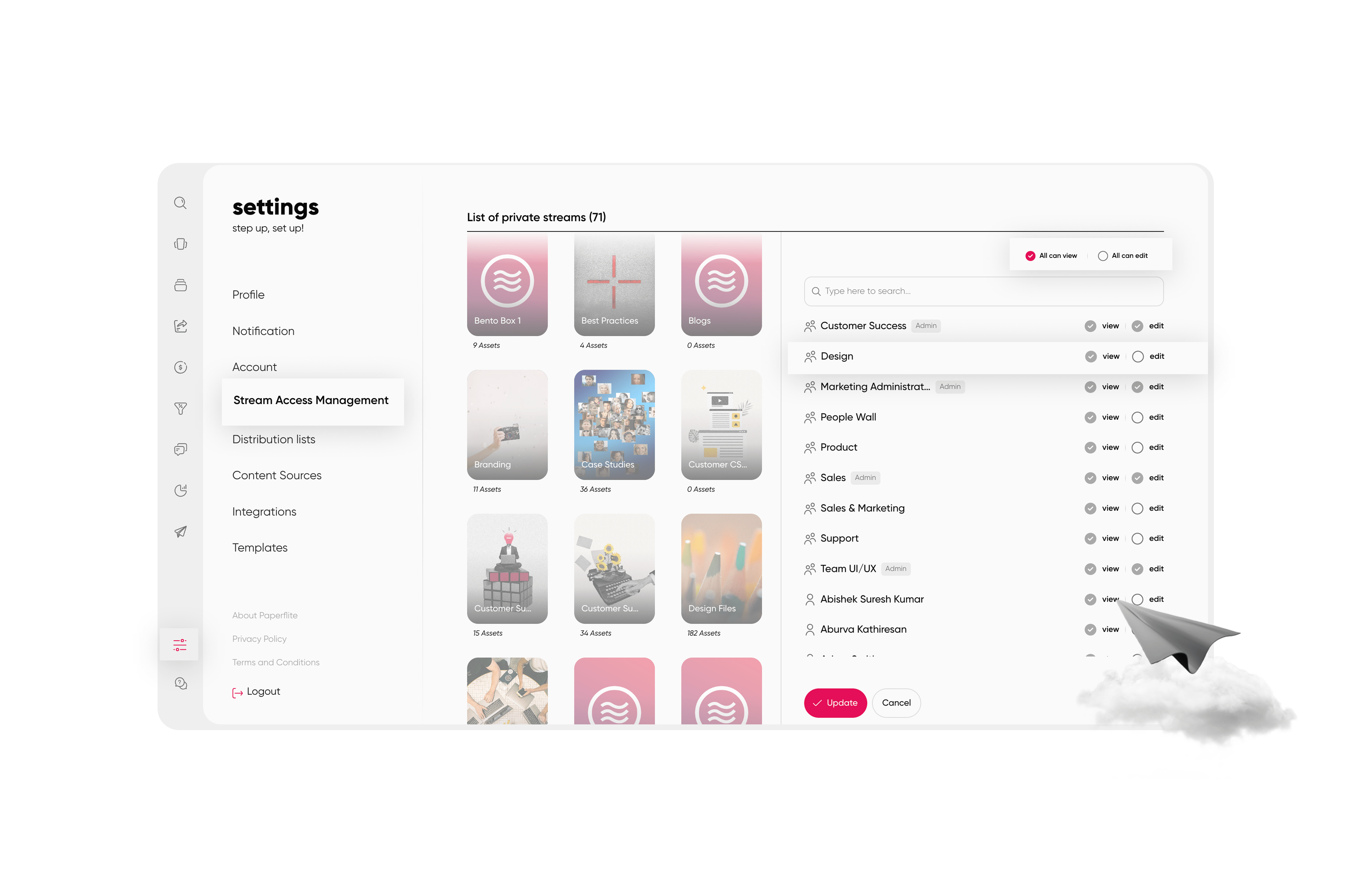

Granular Permissions and Role-Based Access

With rising scrutiny in financial services, compliance can’t be an afterthought.

Paperflite offers fine-grained control over who sees what, how they access it, and what they can do with it.

Whether you're managing internal training documents, investor decks, or client disclosures:

- Set permissions by department, role, geography, or user.

- Enable secure view-only access or allow edits for collaboration.

- Track every access and action for full auditability.

It’s ECM-grade control, but with a user-friendly interface built for speed.

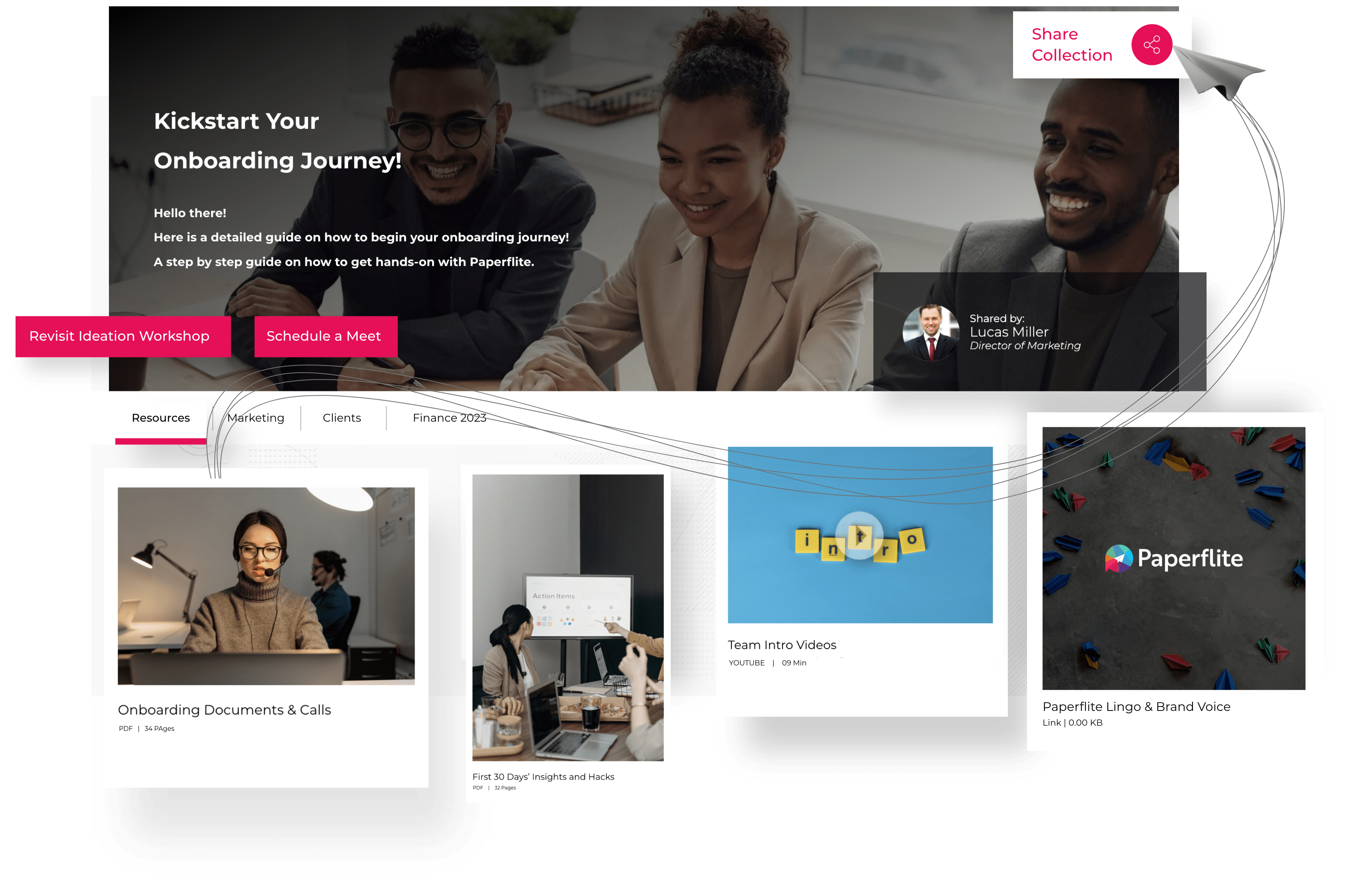

Personalized Client Microsites (Collections)

Clients don’t want Dropbox folders or 12-email threads.

They want clarity.

Paperflite’s Collections allow relationship teams to create branded microsites containing only the most relevant content proposals, case studies, investment insights, or compliance docs.

Each Collection:

- Can be customized per client,

- Tracks what gets viewed,

- Supports real-time updates and notifications.

It’s a seamless, polished experience that mirrors the expectations of modern banking clients.

Multi-Format Content Support

Financial content comes in all shapes—videos, Excel models, PDF disclosures, PPT decks and Paperflite supports them all natively.

Content is:

- Displayed using purpose-built immersive viewers,

- Tracked across formats for engagement metrics,

- Accessible through a unified interface, no format juggling required.

Whether it’s an RFP document or a video message from your CIO, Paperflite makes it easily consumable and actionable.

How IADB Uses Paperflite?

IADB publishes content like policy briefs, datasets, and co-publications to promote transparency and engage the public in development policy.

Using SEEK, Paperflite’s AI-powered discovery engine, users can ask questions and receive context-rich answers sourced directly from these documents.

This makes complex publications more accessible to stakeholders, researchers, and citizens—helping IADB fulfill its goal of informed, inclusive public engagement.

Parting thoughts:

As banking becomes more digital and data-driven, content is no longer just a support function. It is central to compliance, customer experience, and operational speed. Enterprise Content Management gives banks the control, visibility, and efficiency needed to stay ahead in a high-stakes industry.

Ready to transform how your bank handles content? Explore how Paperflite enables secure, compliant, and intelligent content management.